Most people think ESG scores (Environmental, Social and Governance scores) are about making companies more ethical. Cleaner energy. More inclusive workplaces. Better governance. 🙌

It sounds good. Because it was designed to sound good.

But very few understand how ESG is enforced, who defines its morality, and what happens to those who opt out.

This isn’t just about corporate policy. It’s about power—and how it quietly migrated from democratically elected governments to unelected financial institutions.

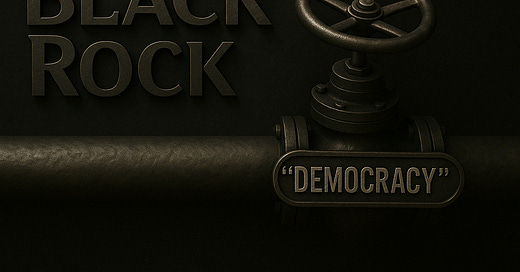

Meet the Valve

BlackRock, the world’s largest asset manager, controls over $10 trillion in capital. That’s more than the GDP of every country on Earth except the U.S. and China.

When BlackRock endorses a standard, it doesn’t need legislation. It just redirects the flow of money.

Want to survive as a company in today’s world? You need access to capital.

Don’t want to comply with ESG? The valve turns off.

This is how the ESG regime works. Not by debate. Not by public vote. But by financial gatekeeping.

And this gatekeeping now reaches into media, activism, and international law.

The UN, NGOs, and Manufactured Morality

Enter the UN Principles for Responsible Investment (PRI). It now boasts over 5,000 signatories controlling $121 trillion in assets.

It sounds like a global consensus.

But it isn’t democratic. It’s engineered.

BlackRock and its peers don’t just sign on—they help define the principles. Then they fund NGOs and media partners who shape public perception, ensuring those principles are embedded in the cultural and legal frameworks of participating nations.

The result? A closed loop of ideological enforcement:

• Asset managers create the standards.

• NGOs and media evangelize them.

• Governments quietly fall in line.

This is what Blackrock CEO Larry Fink meant when he said “we have to force behaviours.”

This is how globalism works in the 21st century. Not through tanks or treaties. But through compliance economics.

Why It Matters

If you think this only affects corporations, think again.

When financial access depends on ideological alignment, dissent becomes unbankable.

And when influence over capital flows replaces the authority of your local government, democracy becomes a façade.

No one voted for BlackRock. No one voted for Klaus Schwab. No one voted for ESG scores.

But try running a business, an institution, or a political campaign without them.

You’ll find out who really holds the valve.

One Last Thought

We were told this was about values. But values, by definition, are supposed to be chosen.

When they’re imposed at the point of financial survival, they’re no longer values.

They’re control mechanisms.

And the first step to resisting them is understanding how they work.

And the first step to resisting them is understanding how they work.

That’s why Canadians should pay close attention to Mark Carney—the former central banker turned globalist architect of ESG enforcement. Carney isn’t just a voice in this system. He helped build it. And if he ascends to political power, Canada could become the prototype for a fully moralized financial surveillance state—where compliance is rewarded, and resistance is punished in silence.

Share this with someone who thinks ESG is just about helping the planet. You might change their mind before the next valve turns.

Excellent post. Thank you.

What better name than Fink, eh?